A guide to everything about budgeting

When it comes to your own personal finances, there’s a good chance that you have specific goals in mind that you want to achieve.

Now if you’re actually serious about reaching those financial goals, a large part of your success will depend on your ability to take control of your savings and spending habits. This is exactly where both creating a financial plan and creating a budget come into play. In this article, we’ll be focusing on the budgeting side of things.

For today, and for the next ten minutes you spend reading this, we’ll make sure to cover all of the fundamental areas of budgeting that will hopefully answer all of your questions and leave you feeling like a financial expert. Here’s a sneak peek at some of the questions we’ll be answering in more detail:

What is a budget?

What are the steps involved in creating a budget?

What are some of the most useful budgeting methods?

What are some useful budgeting tools?

How does your budget and financial plan work together?

Without further ado, let’s get to it. Here’s everything you need to about budgeting:

Part I. What is a budget and why should you have one?

Let’s be real for one moment, budgeting isn’t exactly the most exciting thing to think about or start doing. But despite what you’ve already heard when it comes to budgeting, there’s nothing you should ever be scared of when you start creating one.

The most basic definition of a budget reads something like this:

A budget is an estimate or a snapshot of income and expenditures over a period of time.

Sounds… well, pretty vague doesn’t it? Now, I’m sure you get the point, but why stop there? Let’s take it a little further than just a simple definition.

Budgeting is an underutilized, yet extremely important financial exercise that can give you an accurate overview of how much income you’re making and where exactly your money is going for any given time period.

By far, the best part of any true (or good) budget is that it provides you with broad financial insight by showing you if you make enough money or if you spend too much money.

Your budget can and should help you identify where you’re spending too much of your hard-earned money. At the same time, it can also help you identify how you can better put your money to work for you. So what exactly does this mean?

Essentially, it means that by creating a budget you’ll be on your way to making room for more savings, paying off debts, or even setting up an emergency fund that’s on the top of your priority list.

A good budget provides as much detailed and accurate information as possible when it comes to your spending habits and income. A great budget also includes specific goals.

While it should go without saying, I should caution you that your first month of budgeting (if you’re new to it, of course) won’t be easy. Just like anything else new you take on, it requires time and dedication to improving. For the first month or so, it’s about getting into the habit of budgeting.

As you make budgeting a natural habit, you’ll be able to plan your expenses better as you pin down more accurate estimates of your cash flow. Coming up with a spending plan is necessary to see where your money is coming from, where it’s going, and how much is left for you to spend or save.

With the alarming amount of American households living paycheck-to-paycheck, it’s clear now more than ever how important creating and sticking to a budget is for your overall financial success.

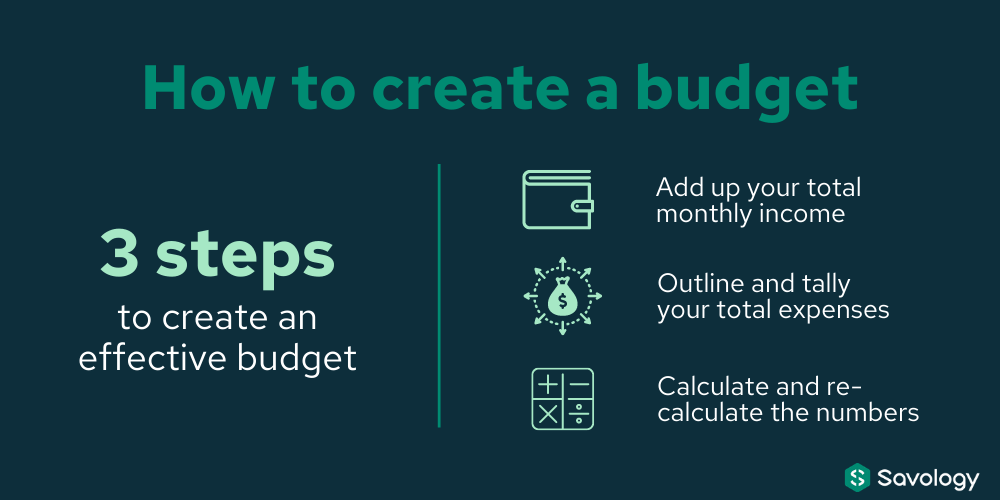

Part II. How do I create a budget and what are the steps involved?

Now that you’re familiar with what exactly a budget is and the basic concepts of budgeting, it’s time to start diving into each component that makes up a budget. After going through these sections, you should have a good enough understanding to create your own budget from scratch.

Step 1. Add up your total income (monthly)

Before figuring out or tracking your expenses, the first step you should take is figuring out what your total monthly income is. This should be relatively easy to do and you may be able to do it off the top of your head, but you will still want to double-check things for accuracy.

Remember, income is considered as any money received, especially on a regular or recurring basis. While you’re likely thinking of just your full-time employment, don’t forget to include income from other things such as part-time work or side hustles that are bringing in money. You’ll also want to include passive income that you might have, such as rental property income or investments that pay monthly dividends. Every dollar counts.

Once you have all of your monthly income documented, you’re in good shape. You can choose to move on to the next step, but if you’re looking to get the most out of understanding your budget, I’d recommend breaking your income out annually, monthly, and weekly along with when your money comes in. You’ll thank me later.

Lastly, separate your income even further by identifying what comes in before and after taxes. For this exercise, you will want to focus on the after-tax income as that is the money you have the most control over and that you actually ‘see’ in your accounts.

Step 2. Outline and tally your total expenses

Next, it’s time to calculate your total expenses. Whether you’re budgeting for the week, month, or even quarter, outlining exactly where you need to allocate your spending is critical.

If you’re unsure where to start, which is completely normal, a good starting point is breaking your expenses out into two main categories: fixed costs and variable costs. You can also break down your expenses by classifying them as needs and wants, though that can be a little more subjective.

Your fixed costs are those expenses that are always there no matter what. They’re the expenses that you can’t compromise on, such as rent or mortgage payments, utility bills, phone bills, car loan payments and even your student loan payments.

Your variable costs on the other hand, are expenses that change from month to month. These are often expenses that you can and probably cut down on from time to time. Variable costs usually include expenses such as eating out, clothing, travel, and entertainment costs.

Here’s how I would recommend recording your expenses:

Take a look at your previous bank statements, bills, and even receipts from the previous three months to create a workable average for each category. Doing this will give you a good indicator and baseline for your first month of budgeting. Again, it’s important to keep in mind that it won’t be perfect and your budget will require some adjustments along the way.

Laying these out side by side can help you visualize your cash flow, allowing you to make adjustments such as reducing your budget for going out and putting it towards your retirement income instead.

If you want to take this a step further, I’d recommend breaking out these expenses into weekly, monthly, and annual expenses. This can help you catch or plan for expenses that happen less frequently, like paying your taxes, car registration fees, annual memberships, and more. In turn, you will have a much better representation of not only where your money is going, but when it is coming out of your accounts – something that is often overlooked when it comes to cash flow management.

Step 3. Calculate and re-calculate your budget

Now that you have your expenses (outflow) and income (inflow) written down and figured out, go over them one more time.

Budgeting is all about accuracy, so it’s key to take that extra 20-30 minutes to double-check everything and to make sure that you haven’t skipped over any significant income sources or expenses. It can be valuable to review these with someone else, like your significant other or an accountability partner.

If your total income is greater than your total expenses — great! You can work on prioritizing the excess cash and put it towards increasing your savings rate, paying off your credit card debt, building an emergency fund, or other financial goals you have.

On the flip side, if your expenses end up being more than your total income, then you need to take a look at your current expenses to see what you can either trim down or eliminate entirely. Variable expenses, and “wants”, are typically easier to cut down and eliminate right away, but often times fixed costs can end up having the biggest impact.

While there is no right or wrong in choosing which expenses you decide to reduce, here are a few key things to keep in mind: Prioritize needs over wants, prioritize what you value, be honest with yourself, live within your own means, and revisit your budget frequently.

Personally, I have found it helpful to create the first draft of a budget before finalizing anything. Then, think about the proposed budget for a day or review it with a partner to see how you feel about it.

I also recommend comparing your budget to some of the most common budgeting methods (below) to understand how yours is different and if it is right for you. Then, after a final round of adjustments, commit to trying your new budget out for a month or more.

You can view the image below for a good quick reference on 5 steps (with the 3 major parts above) you should be taking when creating your own budget:

Part III. What are some popular budgeting methods?

By now you have a good understanding of what a budget is, and how to create one from scratch, but you might be wondering what some of the most popular methods are when it comes to budgeting. While a lot of different techniques and methods exist, here are a few of the most common:

Budgeting method #1: The 50-30-20 rule

Sometimes referred to as the Balanced Money Formula, the 50-30-20 rule is one of the simplest budgeting methods and also one of the easiest ones to get started with.

This budgeting method, or rule, states that you should spend up to 50% of your after-tax income on expenses that are considered “needs” such as rent or mortgage payments, insurance, etc.

The remaining half should be split up between 30% into “wants” and 20% into “savings” (and debt repayment). This method provides a lot of flexibility to spend within your wants while ensuring that you also have a set amount allocated to save or pay down debts.

Budgeting method #2: The 60% solution

Next, is the 60% solution budget. Similar to the 50-30-20 rule, this type of budgeting uses percentages of your income to manage your money.

The rule is quite simple where 60% of your income is allocated towards committed expenses. These include expenses such as your mortgage, rent, utilities, food, basic clothing, car payments, insurance, etc.

This differs from the 50-30-20 rule where now every single one of your bills is included in this “needs” category. Essentially, these are the bills and expenses that have to be paid each month.

The remaining 40% of your income is then divided into four categories with 10% allocated to each category. The four categories are:

1. Retirement

2. Long-term savings

3. Short-term savings

4. Fun Money or Vacation funds

Budgeting method #3: Zero-based budgeting

Last but certainly not least on our list of budgeting methods is the Zero-Based Budget. This is where you start with a clean slate for each new period. Each expense must be reconsidered and reallocated every time without regard for prior periods.

This is my favorite method of all three, but it is also the most challenging one when it comes to disciplining yourself and staying on top of it.

Essentially a Zero-Based Budget (sometimes shortened to ZBB) ensures that every dollar serves a very specific purpose and is put into action. It also ensures that you live within your means because you only have a certain number of dollars to allocate. The end result is being more efficient with your money and ensuring there is no room for overspending or pulling out the credit cards on impulse purchases.

Part IV. What are some popular and useful budgeting tools?

If you’re like me then you probably prefer sticking to the old-fashioned pen and paper method or even spreadsheets to keep track of your spending habits. But if you’re not, I promise I won’t get offended one bit. In fact, I recognize the significant value in switching it up from time to time and trying something new.

So, if you’re on the hunt for new, innovative, and easy ways to create your budget, then you’re in luck. There are a ton of very useful budgeting tools that can help automate a lot of the manual work involved, saving you lots of time and keeping you on track.

Below are three of our favorite budgeting apps:

Budgeting tool #1: Mint

Mint is a very popular free-to-use budgeting tool that helps you track and budget your money efficiently mainly by allowing you to quickly connect and sync your bank accounts to the budgeting software. This is how Mint is able to keep track of the spending on your accounts and associated with any card.

One of the nice features that Mint comes equipped with is that it allows you to automatically “set” your budget, while it records your expenses. What’s even better is that Mint automatically separates expenses into categories. This is done initially through assumptions and machine learning. If something shows up in the wrong category, as may happen from time to time, you can easily make the adjustment and correct the category to make sure your tracking is accurate.

Mint is a must-try budgeting tool that also happens to be budget-friendly as it’s free to use. While Mint is free, the company needs to make money somehow. They earn revenue by displaying ads within the app related to financial services like credit cards and personal loans.

Mint has also expanded in recent years to include some credit score tracking and analysis from the same platform.

Budgeting tool #2: You Need A Budget (YNAB)

Next on the list of budgeting tools is You Need A Budget (YNAB). If you are on the hunt for ways to be more active and involved with your finances, while still having some level of automation in place, then YNAB might just be the tool for you.

YNAB allows you to connect your bank account(s) to the tool. Unlike Mint, however, you are responsible for purposefully categorizing transactions that come through.

What’s really interesting is that YNAB seems to be the tool of choice for a lot of personal finance bloggers and experts because of the increased level of personal involvement.

YNAB comes with educational content and videos that focus on financial literacy and teach you how to manage your cash flow effectively.

One of the downsides, at least compared to Mint, is that YNAB is not a free-to-use tool and costs users approximately $12 per month. However, if you are a student, YNAB is entirely free-to-use for one year. For others, they offer short-term free trials.

Read our recent comparison of YNAB vs Mint’s budgeting tools to find out which one you might prefer.

Budgeting tool #3: EveryDollar

Last, but not least, on our list of budgeting apps is EveryDollar. EveryDollar takes a Zero-Based Budgeting approach where the overall premise of the tool is that every single dollar you earn should have a specific job.

EveryDollar has both a free-to-use and paid version of their tool. The paid version allows you to link your bank accounts directly, whereas the free version is a really great alternative for people who take pride when it comes to inputting their purchases and tracking their expenses the good old-fashioned, manual way.

While there may be a lot of similarities between these tools above, there are also a lot of differences. The best thing you can do when it comes to deciding on a budgeting tool to use is to give each one of them a try and see for yourself which one works best for the way you currently manage and want to end up tracking your spending.

Read our recent review of EveryDollar vs Mint to determine which of these budgeting tools is best for your plan.

Budgeting tool #4: Savology’s monthly budgeting calculator (BONUS)

While the above tools are great for consistently keeping tabs on your spending and savings habits, sometimes you don’t necessarily need to rely on a subscription-based tool to get the job done. Rather, using a budgeting calculator to create a snapshot of your budget can often give you the insight you need to start taking action and make changes to how you’re spending, or saving, your money.

We created our free monthly budgeting calculator as an easy, free, and fun way to calculate your monthly budget without having to connect your bank account or worry about big commitments.

If you’re on the hunt for tools outside of the budgeting realm, check out one of our more recent articles that breaks down some of the best free financial tools available.

Part V. How does your budget and financial plan work together?

As you can see, having a solid budget in place isn’t just a nice-to-have financial tool, it’s virtually a necessity. A necessity that works even more effectively when paired with your financial plan.

While a lot of people confuse the two and think they need one or the other, that’s certainly not the case. Your budget is a snapshot of your spending habits and is a tool to help you manage your cash flow.

Your financial plan, on the other hand, is the complete financial picture of everything. It looks at your savings, risk management and insurance, your current debts and liabilities, your housing needs, and your retirement calculations.

Your financial plan will tell you how much you need to be saving based on your own values and goals. Your budget then acts as your savings and spending plan to help you execute effectively on your financial plan.

Final thoughts: One budget isn’t forever

Life happens and situations change, which means that there might be some changes in your life that you need to accommodate. Because of this, it’s important to review your budget and your financial plan every couple of months.

With that in mind, the more diligent and active you can be with your budget, the better off you’ll be financially in the long run.

If you are looking for additional help, see our other articles on budgeting, including these additional budgeting tips.